44+ what is the worksheet used for in accounting

Record income expenses and the template produces an automated trial balance income statement cash flow statement and balance sheet. Fortunately theres a quick and simple way to reset the used range when necessary.

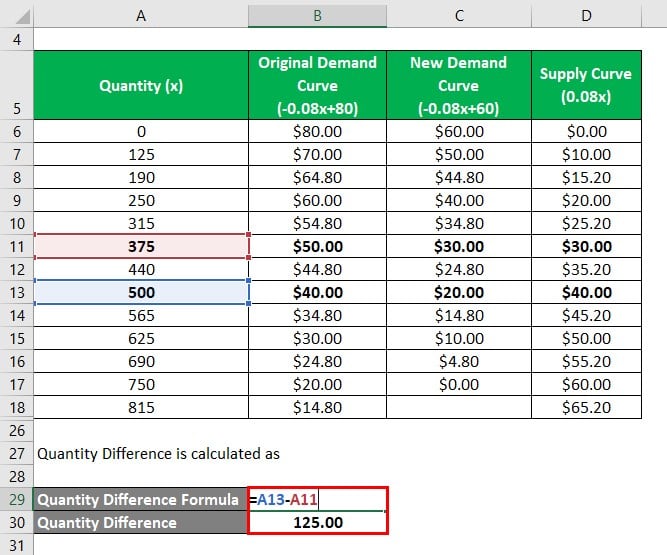

Deadweight Loss Formula How To Calculate Deadweight Loss

31 Net profit or loss.

. Then the expense accounts are closed by a credit to each account and a corresponding debit to Income Summary. The precise knowledge of the cost of production helps the management to decide the price of. If a profit enter on both.

The subject of this workbook is the Double Entry Accounting System. Form 1040NR line 13 and on. This article reflects the opinions and explanations of Robin and I.

Nevertheless the per unit data suggest that the CAPlayer is losing money because the sales price is below the 6444 unit cost. Deferred tax is neither deferred nor tax. A spreadsheet is a computer application for organization analysis and storage of data in tabular form.

Subtract line 30 from line 29. As with many aspects in Excel the used range is fraught with nuance but you can easily set up an example to understand the concept. The inventory measurement is then used to calculate the Cost of Goods Sold for a company.

An accounting information system AIS is a structure that a business uses to collect store manage process retrieve and report its financial data so it can be used by accountants consultants. It is used to study the nature of relation between two variables. The properties of a cell that can be formatted include.

With the use of professional font style and font size in the MS Word prepare a document of questions that are related to the topic of accounting. Spreadsheets were developed as computerized analogs of paper accounting worksheets. The program operates on data entered in cells of a table.

Use the following information to answer questions 42 - 47. Variable percentage withdrawal VPW is a method which adapts portfolio withdrawal amounts to the retirees retirement horizon asset allocation and portfolio returns during retirementIt combines the best ideas of the constant-dollar constant-percentage and 1N withdrawal methods to allow the retiree to spend most of the portfolio using return-adjusted. It consists of an 80 - 30 year first lien at market rates a 10 - 15 year second lien at a slightly higher interest.

This resulted in a 400000 profit as shown. A manual accounting system is a system of recording transactions by hand. As required by Section 204 of the Sarbanes-Oxley Act we are amending Regulation S-X to require each public accounting firm registered with the Board that audits an issuers financial statements to report to the issuers or investment companys audit committee.

Use the basic accounting template if you have a service-based business and do not need to issue invoices. It is an accounting measure more specifically an accrual for tax. Thus it is used in three journal entries as part of the closing process and has no other purpose in the accounting records.

To report all revenues earned during the accounting period. Double Entry Accounting is surprisingly simple and is built around only a very few concepts a balance. To accurately report the liabilities on the balance sheet date.

On December 1 your company paid its insurance agent 2400 for the annual insurance premium covering the twelve-month period beginning on December 1. 5 Steps to Prepare Accounting Questionnaire Step 1. The accounting equation and balance sheet will show assets Prepaid Insurance overstated by 200 and owners equity overstated by 200.

This is the first of our three accounting templates in Excel. To report all expenses incurred to produce the revenues earned in the accounting period. Glossary of Real Estate Terms 80-10-10 A type of blended mortgage loan which avoids private mortgage insurance PMI.

You can also use other computer applications as well as per your preference. Fonts colors patterns borders alignment and number formatting. Different accounting methodologies such as FIFO LIFO and Average Cost method determine the beginning and ending inventory for a company.

As illustrated in Figure 1 carry out these steps in a blank worksheet. The consultant used ABC and concluded that CAPlayer is more profitable than GLASSESong. Temporary accounts are used to record accounting activity during a specific period.

Cost of Goods is an important metric that is used to determine Gross Profit for a company. Finally the balance in Income Summary is cleared by an entry that transfers its balance to Retained Earnings. 90-38 with respect to certain changes in depreciation or amortization and modifies other revenue procedures to conform with.

This system has been in use since at least the 12th century and it continues to be the most effective financial accounting system today. Im very proud to publish the first guest post ever in this website written by Professor Robin Joyce FCCA who will explain you in a detail how to understand deferred taxation and how to tackle it in a logical way. Line of Best FitEyeball Method A line of best fit is a straight line drawn through the maximum number of points on a scatter plot balancing about an equal number of points above and below the line.

Salary table 2021-dcb incorporating the 1 general schedule increase and a locality payment of 3048 for the locality pay area of washington-baltimore-arlington dc-md-va-wv-pa. Eng has employed a consultant to review costing techniques. Schedule SE line 2.

And b the part of your home used for business. Use the SimplifiedMethod Worksheet in the instructions to figure the amount to enter on line 30. Type the number 100 in cell A10.

This document provides an automatic consent procedure allowing a taxpayer to make a change in method of accounting for certain depreciable or amortizable property after its disposition waives the two-year rule in Rev. This section describes the methods and properties that are available for formatting cells in Excel. In this lesson youll learn about three types of inventory but most specifically work-in-progress inventory.

To accurately report the assets on the balance sheet date. 1 all critical accounting policies and practices used by the issuer 2 all. Youll also learn about inventory costs captured during the production process.

Income summary is a holding account used to aggregate all income accounts except for. If push-down accounting is not used what amounts in the Building account appear on Duchess separate balance sheet and on the consolidated balance sheet immediately after acquisition. In managerial accounting the term product cost refers to the overall production cost that is incurred to manufacture products or provide services.

Some assets may have been used up during the accounting period. Discover what businesses still use these systems their advantages and disadvantages and the definitions of single-entry. Form 1040 line 12 or.

Prepare a Word Document. Each cell may contain either numeric or text data or the results of formulas that automatically calculate and display a value based on.

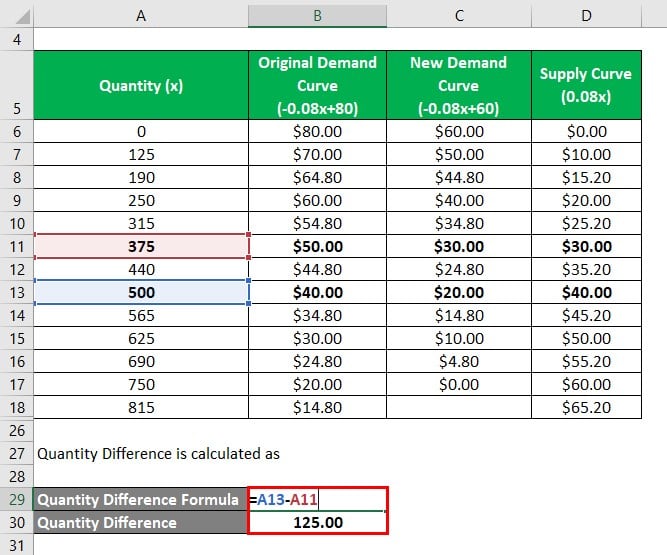

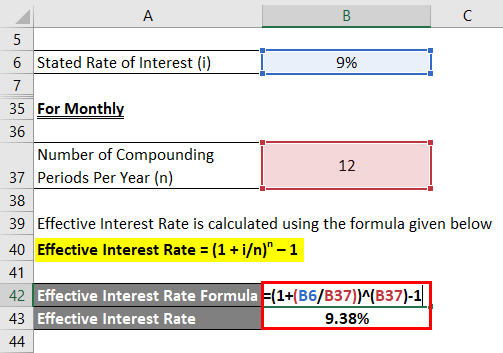

Effective Interest Rate Formula Calculator With Excel Template

Explore Our Sample Of Root Cause Analysis Action Plan Template For Free Action Plan Template Excel Templates Multi Step Equations Worksheets

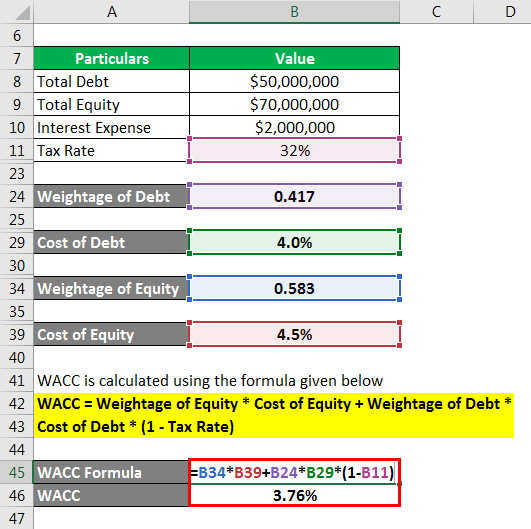

Wacc Formula Calculator Example With Excel Template

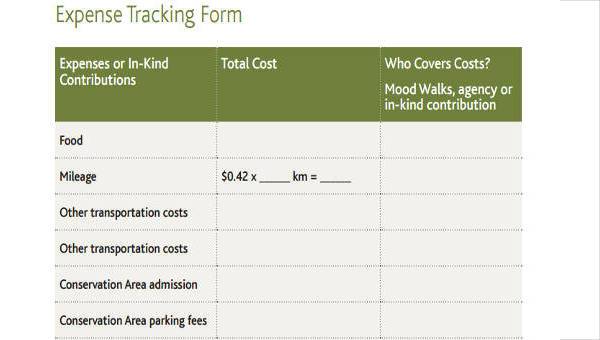

Free 44 Expense Forms In Pdf Ms Word Excel